It is not surprising when small to medium sized business owners query about Debits and Credits and the whole system of double entry bookkeeping, but it is a shock when you ask an accountant and they can’t explain it, although most of us accountants use the system day in day out.

I would like to share a feeble philosophy that I like to call ‘The World of Accounting’.

The two fundamental statements portraying your financial position are called the Income Statement/Profit and Loss Account and the Balance Sheet.

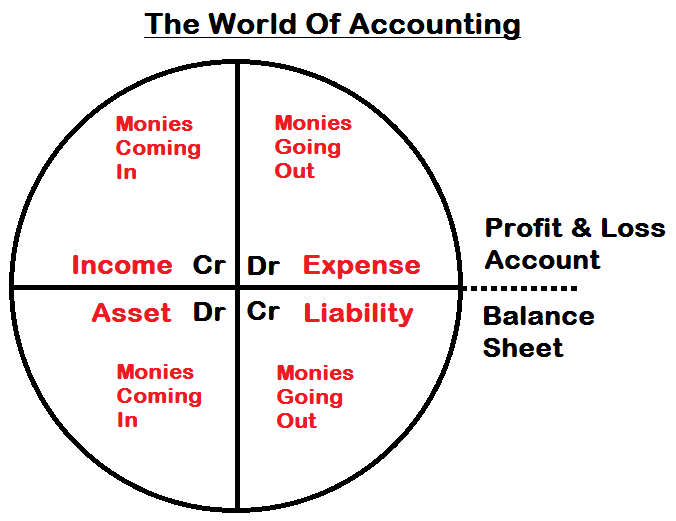

As you can see from the above diagram, the top half of ‘the world’ is the Profit and Loss Account and the bottom half is the Balance Sheet.

Here, the terms Debit, represented as ‘Dr’, and Credit, represented as ‘Cr’, have been arranged in the four quadrants of ‘the world’.

In red, you can see how ‘the monies’ (which is fundamentally what is being depicted in the accounts) are shown to be either coming in to the business or being paid out by the business.

To be more precise, a Credit in the Profit and Loss Account is usually monies coming in, and hence, a Debit is usually monies being paid out.

Contrary to the Profit and Loss Account, in the Balance Sheet, a Credit is usually monies that must be paid out, and a Debit is usually monies that will be paid in to the business.

Take a basic transaction as an example:

A sales invoice worth £100 would consist of a double entry transaction as below:

Cr: Income in the Profit and Loss Account

Dr: Trade Debtors in the Balance Sheet

This accounts for the sale in the Profit and Loss Account and shows, in the Balance Sheet, that the business is owed £100 by a customer.

Once the cash is received by the business:

Cr: Trade Debtors in the Balance Sheet

Dr: Cash in the Balance Sheet

This now leaves a nil balance in Trade Debtors as the Cr balance is set off against the initial Dr balance, stating that the customer no longer owes the business the £100.

However, the new Dr balance is shown in Cash in the Balance Sheet, this simply means the business now has £100 worth of cash.

The above transactions are very basic transactions and are used by bookkeepers and accountants relentlessly in their day to day work.

There are more complex transactions that appear once in a while that are a joy for some bookkeepers and a nightmare for others, such as a transaction involving an acquisition of a Motor Vehicle on a long term lease with the deposit paid with an existing Motor Vehicle as part exchange.

Let me know if you want to know the double entry of that one!!